With this end value growth now slowing, the get out for developers is no longer present and an attentiveness to controlling cost wherever possible is essential. The growth in end GDV values we saw in the last couple of years has helped offset construction cost increases and maintained, or indeed improved, margins for developers.

The cost of construction is potentially more problematic if not closely monitored and a focus for us in choosing which developments to back in the current market. Our diverse sources of capital allow us to more reliably fund projects whilst supporting developers with our in-house property expertise. We have again seen a number of projects coming to us where lenders have stopped funding mid-project - putting the project, and ultimately the lenders' capital, at risk. Just like at the start of the pandemic, this shock has highlighted the importance of having stable and reliable funding lines for projects. The key to delivering projects is then having the reliable funding to complete the development and controlling costs to maintain a margin. Our regular State of the Market bulletin provides ongoing analysis of this and the key factors affecting our developers and I recommend subscribing to it. For the developers we support, end values are likely to remain reasonably stable. Whilst it is easy for the tabloid headlines to portray doom and gloom, a small fall in house prices will only offset a part of the price growth seen during the pandemic years. We did not see quite as rampant price growth as some overseas markets, where prices are already falling, but inevitably there will be some softening in growth if nothing else.

This ongoing lack of supply supports prices and with no immediate prosect of housing supply increasing, this ongoing lack of supply will likely support house prices going forward. With the ever totemic 300,000 unit target never being achieved, housing starts fell during the pandemic and this reduced supply is what is now getting brought to market. People still need to move and buy houses and there is, as ever, an undersupply of new stock to the market. Reduced disposable incomes as a result of inflation across the economy reduce the mortgage sum that can be advanced and there are limits as to how far people can stretch themselves, or are willing to, with negative sentiment about the economic outlook. Just as much as mortgage rates impact lending, the cost of living increases seen across the economy also have an impact (and consequentially on house price growth) as these feed into the affordability assessments that mortgage lenders are required to carry out. And with historical rates more like 5.6%, it is probably reasonable to expect to find ourselves back at this level in the short and medium term (excluding some other geopolitical event / global shock). We now find mortgage rates coming back down even as the BoE base rate continues to increase, showing the improvement of market sentiment / common sense. I personally don’t think it was good for the economy and inevitably we were at some point going to find debt moving towards longer term average rates - albeit the move should have been more gradual and not involved the overshoot that the sudden shock produced. That said, none of us want to live in boring times and - given the upcoming festive period - possibly we should say that whilst there may be trouble ahead, better to face the music and dance.Īlthough the extent of the recent turmoil was self induced to a degree, it is important to reflect that we have had a sustained period of almost unprecedentedly cheap money and this was never going to be sustainable. Following the joys of the brief Truss/Kwarteng debacle and resulting market jolt, this phrase looms in my conscious again and seems to have sadly become a refrain.

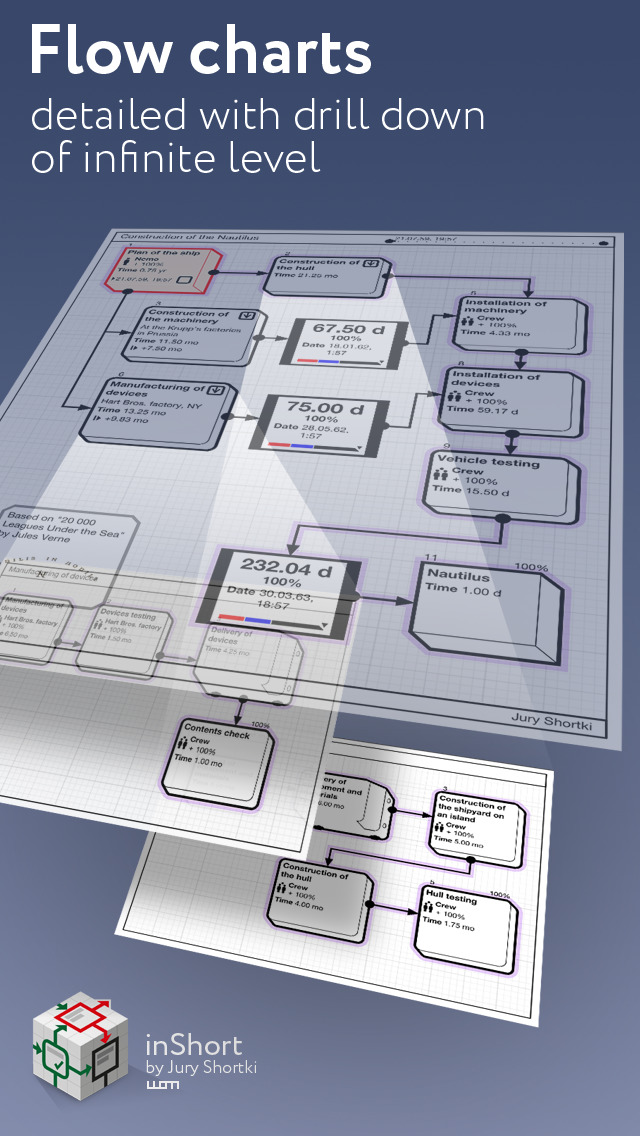

#Inshort review series

I have a slight sense of déjà vu as I pen this: a year ago, the first blog in this series opened with the purported Chinese curse “may you live in interesting times” and my second blog repeated this. Tom Short, CrowdProperty's Head of Credit, shares his thoughts on the property market over the past 12 months and expectations for 2023.

0 kommentar(er)

0 kommentar(er)